Schedule Your FREE Credit Consultation!

WHY CHOOSE US?

Free Evaluations

Flexible Payment Options

Personalized Video Updates

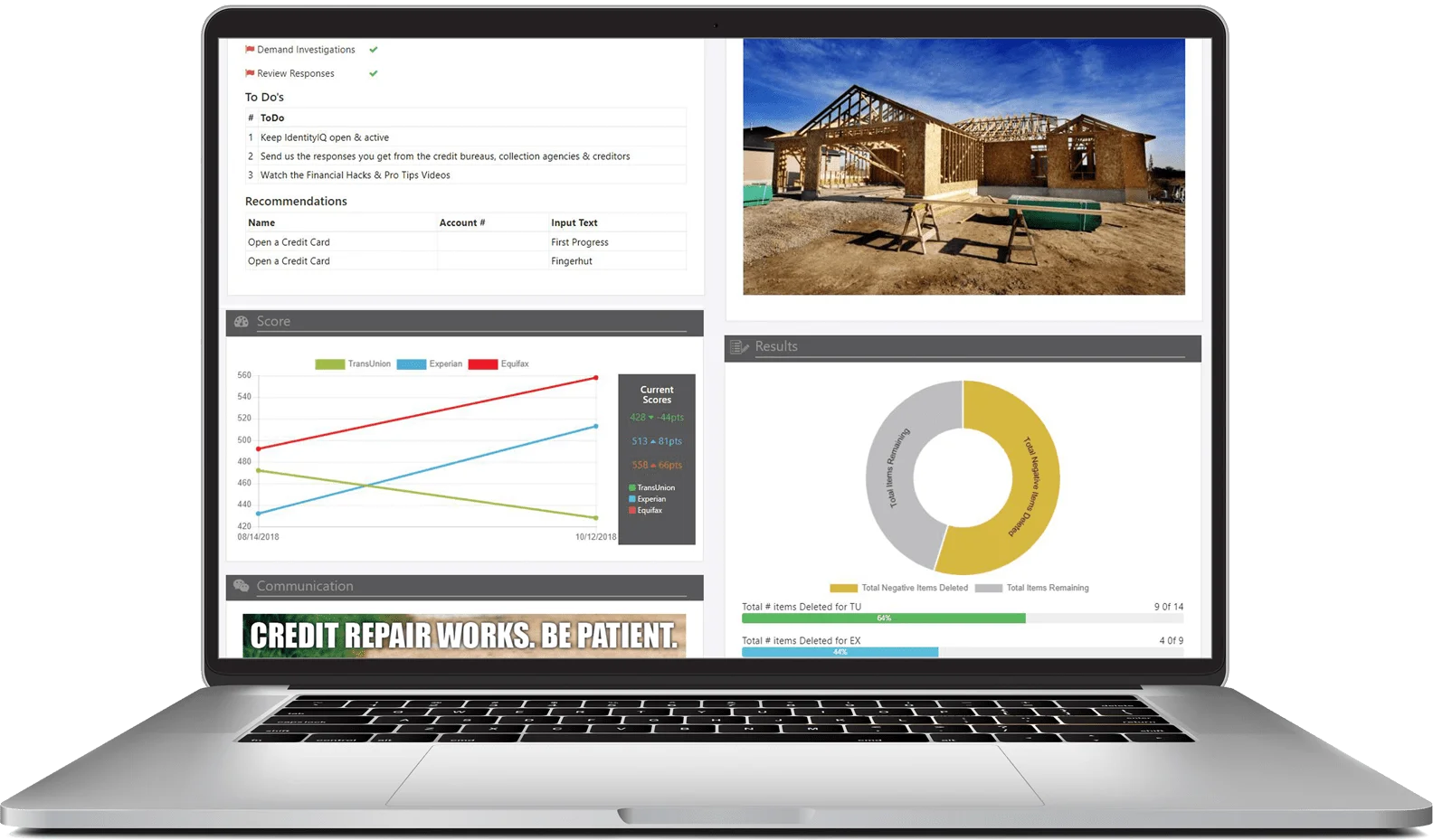

Complete Tracking WebPortal

Weekly Video Coaching

5-Star Reviews & Reputation

We Stand Behind Our Work

We Are Committed To You

Yes. The amount of negative items that get deleted from everyone’s credit report can be very different because no two situations are the same. If an item is not 100% Accurate, 100% Verifiable, and Timely we work diligently toward getting them removed for you. In addition to working on the negative items on your credit report everyone will benefit by the additional tried and true tactics we will teach you to both raise and maintain your credit score.

Items can be seen getting removed in as little as 30 days. However, a complete process with ideal results typically takes longer than that.

We have two different pricing models tailored towards your needs. Some people need to fix their credit because they're looking to buy a home as soon as possible. Some people simply want to stop the money bleeding from the everyday rates that bad credit costs.

That's why we have a Pay-for-Success pricing model: it's a little more aggressive, and you only pay once we get negative items removed from your credit report. There is a hard cap on the number of items we will bill you for after we delete them.

Our other program is an installment plan: which is good for when your credit report requires a few less investigations.

Your involvement is making sure that you stay engaged with the content we send you. You'll receive video reports of how we're progressing, when you can expect to see the changes you desire, and make sure to watch our fun, animated, but diligently-researched financial hacks and pro tips video series(you get one a week)!